摘要

在开展跨国业务时,若出现业务终止和商誉转让,如何进行税务处理成为重要议题,该议题本质上往往是在探讨“在代理终止的情况下,收取的款项究竟属于资本利得还是业务利润?”这一性质认定问题。这不仅关乎纳税人如何合理申报,也涉及税务部门如何规范征收。本文以“Chakiat税务争议案”为例,探讨代理终止中的隐藏的税务雷区。

01

案件回顾

本案中,印度公司Chakiat Agencies Pvt. Ltd.(以下简称“Chakiat公司”)是Sea Land Service Inc.的印度子代理,为其处理印度的货运业务。1999年,丹麦A.P.Moller收购了Sea Land Service Inc.,并指定MAERSK作为新代理商。此后,Chakiat公司的代理协议被终止,且Chakiat公司与MAERSK达成协议,将其业务及商誉转让给MAERSK,换取一笔款项。

Chakiat公司认为这笔收入源于商誉转让,符合印度《所得税法》第45条的“资本利得”条款,应享受资本利得减免税收的优惠政策。然而,印度税务部门认为,这笔款项实质上是代理终止补偿,应按《所得税法》第28(ii)(c)条处理,即计入“业务利润”征税。最终,印度高等法院支持了税务部门的观点。

02

法律焦点分析

本案的争议焦点在于如何认定“业务利润”的存在,以及在代理终止的情况下产生的收入中如何厘定和适用《所得税法》中的相关条款。

1.业务利润:根据《所得税法》第28(ii)(c)条,如果在印度持有代理业务的纳税人因代理终止或条款变更而获得赔偿或其他支付,则应将此类收入视为业务利润,按“业务和职业所得”纳税。这一规定旨在防止企业利用代理终止的名义将所得转入资本利得,从而规避较高的税率。

2.资本利得:《所得税法》第45条适用于因资本资产转让而产生的利润或收益。纳税人若能证明相关收入系源于资产转让而非代理终止,则可将此类收入申报为资本利得,并依据《所得税法》第54EC条享受相应的减免。

如前所述,在本案中,Chakiat公司与税务部门对该笔款项的性质认定不一致,从而适用不同的税率。

03

法院的判决与解释

马德拉斯高等法院(Madras High Court)最终支持了税务部门的主张,认定该笔款项应归类为业务利润,主要基于以下几点理由:

1.款项与代理终止的紧密联系:法院指出,Chakiat公司收取的款项与代理终止紧密关联,是其代理终止的直接结果,因此适用于第28(ii)(c)条。若款项主要是由于代理终止而获得的赔偿性质,则不能适用资本利得条款。

2.合同整体解读下的补偿性质:法院在分析中指出,尽管协议中提到:商誉转让,但根据合同整体解读,此款项更倾向于因代理终止而支付的补偿,而非单纯的商誉价值。因此,本案不符合资本利得的条件。

3.资本利得条款的适用限制:若涉及的资产转让行为具有商业实质且无关联代理终止,则应按资本利得处理,但本案中显然并不符合此情况。

04

实务建议

在全球化背景下,跨国公司在税务处理上应格外谨慎。以下为本案所提供的合规启示:

1. 明确收益性质:代理终止款项vs.资产转让收益

在Chakiat案中,法院审查了双方协议,Chakiat公司在合同中将商誉与代理终止合并处理,使得税务部门无法认定商誉转让的款项独立于代理终止,判定其为业务利润。为避免类似误解,企业应在合同中独立列明商誉或资产价值,并说明其支付的具体用途和依据。

示例:

……本协议中所支付的金额XXX,系为补偿代理终止而支付的赔偿金,与任何资产或商誉转让无关。

……本协议支付的金额YYY,系用于转让商誉,相关商誉不包括在代理终止赔偿中。

此外,在合同中,企业还应详细规定支付的时间和条件,尤其是当涉及多项支付时,这可以帮助界定收益性质。

示例:

……代理终止补偿将在协议终止后10天内支付,商誉转让对价在完成交割后20天内支付。

2. 合同条款的税务描述

在签订涉及代理终止、资产转让或商誉转让的合同时,应清晰描述款项支付的具体原因,尽量避免模糊条款,以防止在税务争议中处于被动地位。

规定税务责任分工:合同中应明确双方在税务申报、纳税等方面的分工。

示例:

乙方负责就代理终止相关款项缴纳相应的业务税,甲方仅负责商誉转让部分的税务申报。

此外,由于各国税法可能对代理终止收入有不同的解释,企业应定期审查税法更新,确保申报合规,避免受到税务处罚。

结论

“Chakiat税务争议案”揭示了代理终止与税法适用的复杂性和争议性。对于跨国公司而言,理解并遵守当地税法规定、提前明确款项性质、谨慎拟定合同条款,将有助于减少税务争议,保障公司税务合规和财务利益;如交易可能面对复杂的税负认定,则需事先做好税务筹划以及税务申报相关了解,避免引起后续纠纷或罚款。

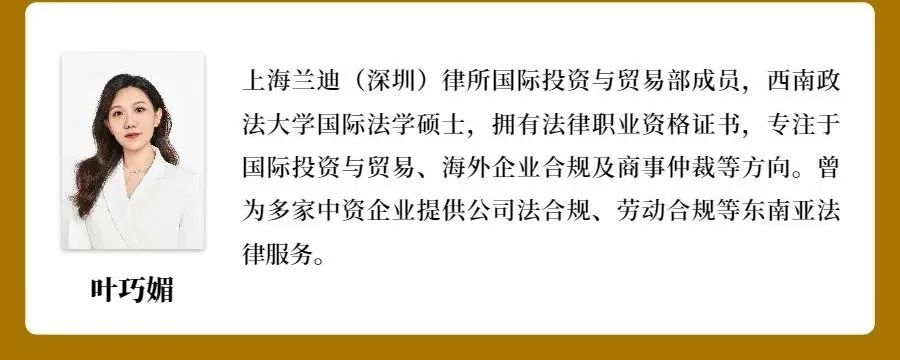

作者/凌茹琳 审核/叶巧媚

注释

1 Section 28. Profits and gains of business or profession.--The following income shall be chargeable to income-tax under the head 'Profits and gains of business or profession',--

(i) ****

(ii) any compensation or other payment due to or received by,--

(a) ****

(b) ****

(c) any person, by whatever name called, holding an agency in India for any part of the activities relating to the business of any other person, at or in connection with the termination of the agency or the modification of the terms and conditions relating thereto.

2 Section 45. Capital gains.- (1) Any profits or gains arising from the transfer of a capital asset effected in the previous year shall, save as otherwise provided in sections 54, 54B, 54D, 54E, 54EA, 54EB, 54F, 54G and 54H, be chargeable to income-tax under the head "Capital gains", and shall be deemed to be the income of the previous year in which the transfer took place.

(2) Notwithstanding anything contained in sub-section (1), the profits or gains arising from the transfer by way of conversion by the owner of a capital asset into, or its treatment by him as stock-in-trade of a business carried on by him shall be chargeable to income-tax as his income of the previous year in which such stock-in-trade is sold or otherwise transferred by him and, for the purposes of section 48, the fair market value of the asset on the date of such conversion or treatment shall be deemed to be the full value of the consideration received or accruing as a result of the transfer of the capital asset.

(2A) Where any person has had at any time during the previous year any beneficial interest in any securities, then, any profits or gains arising from transfer made by the depository or participant of such beneficial interest in respect of securities shall be chargeable to income-tax as the income of the beneficial owner of the previous year in which such transfer took place and shall not be regarded as income of the depository who is deemed to be the registered owner of securities by virtue of sub-section (1) of section 10 of the Depositories Act, 1996, and for the purposes of--

(i) section 48 ; and

(ii) the proviso to clause (42A) of section 2, the cost of acquisition and the period of holding of any securities shall be determined on the basis of the first-in-first-out method.

Explanation.--For the purposes of this sub-section, the expressions "beneficial owner", "depository" and "security" shall have the meanings respectively assigned to them in clauses (a), (e) and (l) of sub-section (1) of section 2 of the Depositories Act, 1996.

(4) The profits or gains arising from the transfer of a capital asset by way of distribution of capital assets on the dissolution of a firm or other association of persons or body of individuals (not being a company or a co-operative society) or otherwise, shall be chargeable to tax as the income of the firm, association or body, of the previous year in which the said transfer takes place and, for the purposes of section 48, the fair market value of the asset on the date of such transfer shall be deemed to be the full value of the consideration received or accruing as a result of the transfer.

(6) Notwithstanding anything contained in sub-section (1), the difference between the repurchase price of the units referred to in sub-section (2) of section 80CCB and the capital value of such units shall be deemed to be the capital gains arising to the assessee in the previous year in which such repurchase takes place or the plant referred to in that section is terminated and shall be taxed accordingly.

Explanation.--For the purposes of this sub-section, "capital value of such

units" means any amount invested by the assessee in the units referred to in sub-section (2) of section 80CCB

点击下方关注我们

网址:www.odilawyer.com